The offshore wind energy market is entering a crucial growth phase characterized by increasing installations and investments. According to the Global Wind Energy Council (GWEC) Market Intelligence, nearly 48 gigawatts (GW) of offshore wind projects were under construction worldwide by March 2025. Following a record year in 2024, where 56 GW of capacity was awarded through global auctions, the sector is poised to auction over 100 GW in the next two years.

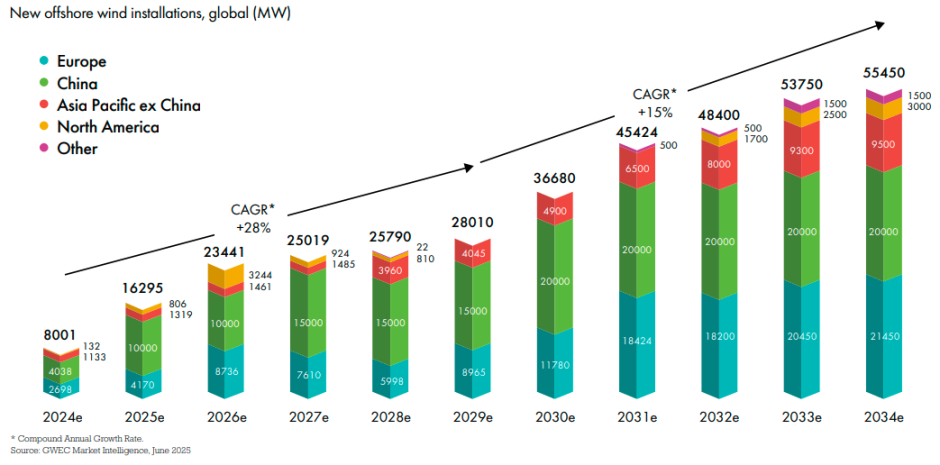

Despite this promising pipeline, GWEC has adjusted its forecast for offshore wind capacity from 2025 to 2029 downward by 24%. This revision is due to economic challenges and policy uncertainties affecting project timelines. Nevertheless, the long-term outlook remains strong, with annual offshore wind capacity additions expected to exceed 30 GW by 2030 and reach 50 GW by 2033. Cumulatively, over 350 GW of new offshore capacity is projected to be installed between 2025 and 2034, increasing total global offshore wind capacity to 441 GW by the end of this period.

Asia-Pacific (APAC), led by China, has emerged as the leading region in offshore wind energy, surpassing Europe in both annual and cumulative installations. Significant advancements in countries like South Korea, Japan, Vietnam, the Philippines, and Australia indicate that APAC is projected to contribute 60% of all offshore wind additions over the next decade.

Conversely, Europe has seen a 30% downgrade in its 2025-2029 outlook. The region is unlikely to achieve 10 GW in annual additions before 2030 or 20 GW before 2033. In the United States, offshore wind growth faces hurdles from a fragile supply chain and policy uncertainty, leading to a forecasted capacity addition of under 6 GW by 2029.

North America is on track to become the third-largest offshore market by 2034, while Latin America is also emerging as a player, with over 245 GW of capacity in the environmental application phase in Brazil alone. By the end of 2024, China and Europe together accounted for 94% of global offshore wind capacity. However, their combined market share is expected to decrease to 89% by 2029 and further to 84% by 2034 as new regional markets develop. Nevertheless, both regions will continue to be central to global offshore wind growth.

Investment strategies in the offshore wind sector hinge on aligning national targets with actual deployment rates. Key factors for achieving projected growth include resolving permitting issues, strengthening supply chains, ensuring effective grid integration, and accessing financing for large-scale projects. GWEC’s forecasting methods consider both project activity and national targets, with short-term projections based on ongoing construction and auction outcomes, while medium-term forecasts assess national commitments and policy frameworks.

As global focus shifts towards energy security and reducing carbon emissions, offshore wind energy is positioned as a vital component of the clean energy transition. If challenges related to permitting, financing, and infrastructure can be addressed, the offshore wind sector is ready to enter a period of remarkable growth, reshaping the global energy landscape.