Indonesia is becoming an attractive destination for investments in renewable energy, with two major sovereign wealth funds, the Indonesian Investment Authority (INA) and the newly formed Danantara, committing to enhanced funding in this sector. During the Energy Transition Forum held on June 25, leaders from these funds outlined their investment priorities, focusing on electric vehicle (EV) battery supply chains, solar energy, and grid modernization.

INA currently allocates about 12% of its $4 billion portfolio to renewable energy, with expectations to increase this figure to between 15% and 20% by the end of the year. The fund is actively supporting the decommissioning of coal plants and is investing in geothermal, solar, and waste-to-energy projects. Notably, discussions are underway for a solar power project that could set a national record for installed capacity.

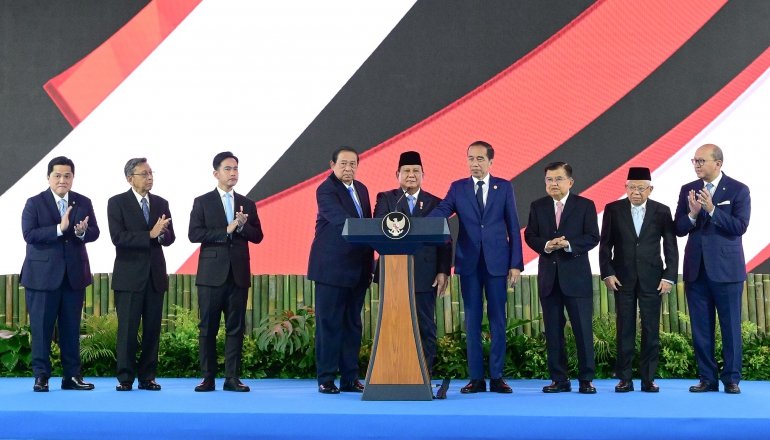

In the EV sector, INA is concentrating on nickel processing, crucial for battery manufacturing, leveraging Indonesia’s rich mineral resources to strengthen its position in the global EV supply chain. A memorandum of understanding (MoU) signed in May between INA, Danantara, and French mining company Eramet aims to establish a domestic ecosystem for nickel production to support EV batteries, with the agreement witnessed by French President Emmanuel Macron and Indonesian President Prabowo Subianto.

Danantara’s Chief Investment Officer, Pandu Sjahrir, highlighted the fund’s dual focus on nickel processing and upgrading Indonesia’s aging power grid, which has been designed primarily for fossil fuel-based energy production. This outdated infrastructure is now seen as a significant barrier to the integration of renewable energy sources.

Launched in February under the Prabowo administration, Danantara oversees assets worth over $900 billion and seeks to invest in nine strategic areas, including mining for battery minerals, biofuel agriculture, and renewable energy generation.

The European Chamber of Commerce in Indonesia (EuroCham Indonesia) is also advocating for the development of low-carbon fuels, including bioenergy. This push aims to enable local companies to capitalize on global decarbonization trends, facilitating export-led growth. Thomas Wagner, the head of EuroCham Indonesia’s energy working group, stated that Indonesia should act quickly to develop low-carbon fuels like bio-based sustainable aviation fuel and bio-methanol, which have the potential to generate up to $8 billion annually in exports. He cautioned that delays could allow competitors in Malaysia, Japan, and South Korea to gain an advantage in this emerging market.

Overall, Indonesia’s commitment to renewable energy investment, supported by sovereign funds and industry advocacy, marks a significant shift toward a more sustainable energy future.