The European Commission has unveiled a new set of tax incentives aimed at accelerating the transition to clean technology across the EU. This initiative, part of the Clean Industrial Deal (CID), seeks to bolster the EU’s Environmental, Social, and Governance (ESG) framework while advancing its long-term objective of achieving carbon neutrality by 2050.

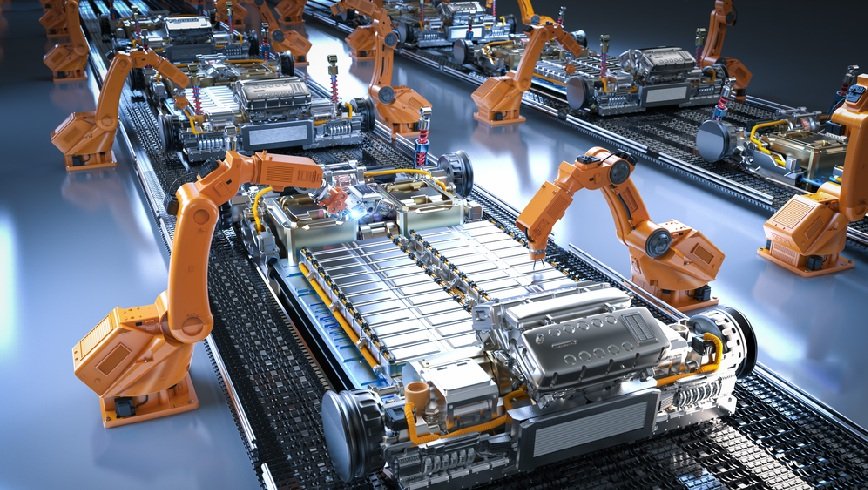

**Key Features of the Tax Incentives** 1. **Accelerated Depreciation**: Companies can now deduct the full costs of eligible investments in clean technologies, such as renewable energy systems and energy-efficient machinery, in the same tax year. This measure decreases initial tax liabilities, thereby improving cash flow and encouraging rapid investments in decarbonization efforts.

2. **Targeted Tax Credits**: Refundable and offsettable tax credits will reduce corporate tax obligations for funds allocated to clean technology and sustainability initiatives. These credits are aligned with the Clean Industrial State Aid Framework (CISAF), simplifying the process for companies to access EU funding without complicated grant applications.

**Strategic Principles** – The incentives are exclusively for clean technologies, excluding any fossil fuel-related projects. – Clear and straightforward eligibility criteria aim to facilitate implementation. – Timely execution of these measures is designed to influence ongoing investment decisions.

These tax incentives adhere to established EU state aid regulations, particularly under CISAF Sections 5 and 6. They also align with Commission Regulation (EU) No 651/2014, which covers broader sustainability projects, including zero-emission vehicles.

**Economic Implications** The introduction of these tax measures is vital for fostering a competitive and resilient industrial landscape within the EU. By reducing financial barriers, the European Commission aims to empower businesses to spearhead the green transition and ensure a level playing field for companies focused on sustainability. Member States are urged to adopt and implement these incentives promptly, while the Commission will oversee progress reporting and the sharing of best practices.

This strategic push positions tax policy as a fundamental driver for enhancing ESG performance and achieving the EU’s carbon neutrality goals.