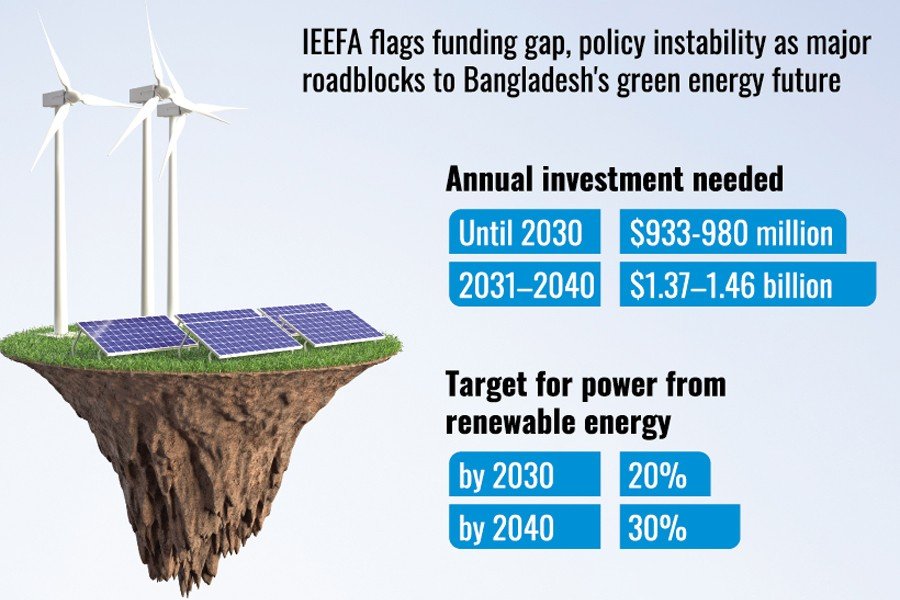

Bangladesh requires nearly $1 billion in annual investments to achieve the targets set in its updated Renewable Energy Policy, according to a report released by the Institute of Energy Economics and Financial Analysis (IEEFA). To realize these ambitions, the country needs to invest between $933 million and $980 million each year until 2030, escalating to between $1.37 billion and $1.46 billion annually by 2040.

The updated policy aims for 20% of the nation’s electricity to come from renewable sources by 2030, increasing to 30% by 2040. However, public funding alone is insufficient to meet these financial requirements, as highlighted by co-author Shafiqul Alam, IEEFA’s lead energy analyst for Bangladesh. The report warns that several challenges, including abrupt policy shifts, off-taker risks, technology uncertainties, a weak project pipeline, and land acquisition difficulties, may hinder private sector investment.

Recent government actions, including the suspension of 31 utility-scale renewable energy projects that had previously received Letters of Intent (LoIs) under a non-competitive bidding process, have created uncertainty for investors. The shift to competitive bidding has raised concerns regarding contracts and investor confidence.

To attract more private investment, the report suggests engaging with multilateral development banks and international climate finance institutions. It recommends establishing a currency hedging fund to mitigate currency risk, which is essential in light of the country’s low sovereign credit rating. Moody’s downgraded Bangladesh’s credit rating to B2 in November 2024, following a decline in expected economic growth and heightened political and banking sector risks. This has made borrowing more expensive for the country, further deterring foreign investment.

The report emphasizes the need for regulatory stability and the restoration of investor guarantees. It also advocates for the mapping and allocation of land for renewable energy projects, as well as the development of capacity within both banking and service provider ecosystems.

To address land acquisition challenges, the report proposes utilizing a public-private partnership model. This could facilitate investment in renewable energy projects through special economic zones. For small-scale projects, the report notes that deployment will depend on reducing high import duties on critical components and improving performance reliability. Easing lending norms for green funds could further support the growth of these projects.

The government has recently taken a positive step by lowering customs duties on imported solar inverters. The report urges further reductions in import duties on essential components for small-scale solar projects, including solar panels and mounting structures.

To minimize delays and simplify financial disbursements, the report also recommends adopting a pre-finance modality for the central bank’s green funds. The collaborative efforts of the government, international organizations, financial institutions, private investors, and renewable energy companies are essential to create an environment conducive to innovation and sustainable growth in Bangladesh’s renewable energy sector.