North America’s offshore wind industry, still developing compared to Europe and Asia-Pacific, is expected to grow significantly over the long term, primarily due to advancements in the United States. As reported by the Global Wind Energy Council (GWEC), the region reached 172 megawatts (MW) of installed offshore wind capacity by early 2025, with four major utility-scale projects under construction totaling 5 gigawatts (GW).

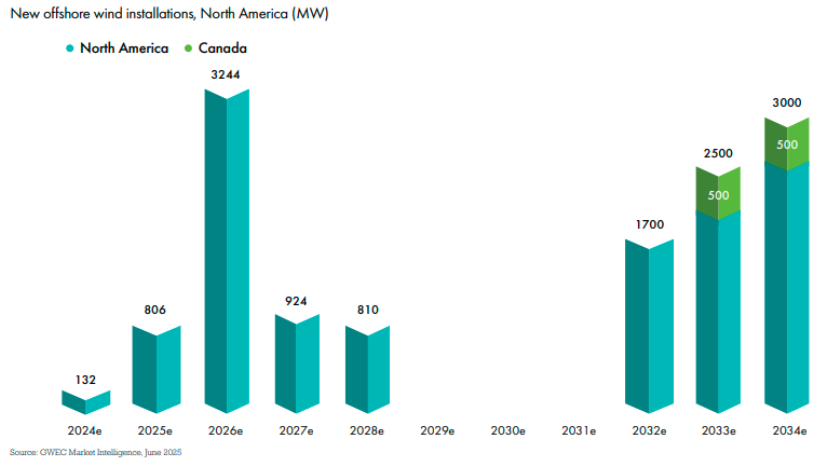

GWEC Market Intelligence forecasts that North America will add 13 GW of offshore wind capacity between 2025 and 2034, with nearly half of this capacity projected to come online within the next five years. The United States is anticipated to contribute 92% of this growth, while Canada is expected to add approximately 1 GW.

Despite this positive outlook, a series of investment trends and policy changes are reshaping market expectations. Initial enthusiasm for the U.S. offshore wind market has been dampened by macroeconomic factors such as high inflation, escalating capital costs, and a strained local supply chain, particularly the shortage of specialized vessels. These issues have created significant obstacles for developers. As of early 2024, 13 fixed-bottom offshore wind projects, totaling nearly 12 GW, faced disruptions, with nine projects representing 7.7 GW either losing offtake agreements or being completely canceled.

The regulatory environment shifted dramatically in January 2025, when President Donald Trump resumed his presidency and issued an Executive Order to temporarily suspend all offshore wind leasing on the U.S. Outer Continental Shelf. This decision halted new project developments and introduced additional regulatory uncertainty, including the potential cancellation of permits that had been granted during the Biden Administration. Projects such as the 2.8 GW Atlantic Shores and the 810 MW Empire 1 are under ongoing scrutiny, even as efforts are made to lift stop-work orders on them.

Investment interest has also declined due to newly imposed tariffs on imported materials and components essential for offshore wind construction. Consequently, several developers have reduced their activities, leading to a thinning project pipeline. GWEC has adjusted its offshore wind capacity forecast for the U.S. by 2030 downward, revising it from 15 GW to below 6 GW.

Nevertheless, several key projects remain on track for completion, including Vineyard Wind 1, Revolution Wind, Coastal Virginia Offshore Wind (CVOW), Empire Wind 1, and Sunrise Wind. The North American offshore wind sector now stands at a pivotal point. While the long-term growth potential is evident, the immediate investment climate faces challenges from policy reversals, economic difficulties, and supply chain issues. Should a future administration reinstate support for offshore wind, it may take years to regain momentum and advance large-scale projects. Developers and investors will likely need to focus on resilience, seek policy clarity, and prioritize the development of a robust domestic supply chain.