The offshore wind energy sector in Asia-Pacific (APAC) is rapidly expanding, driven by government targets, energy security needs, and climate commitments. According to the Global Wind Energy Council (GWEC), APAC is expected to dominate the global offshore wind market in the next decade, with China maintaining a leading position through 2027.

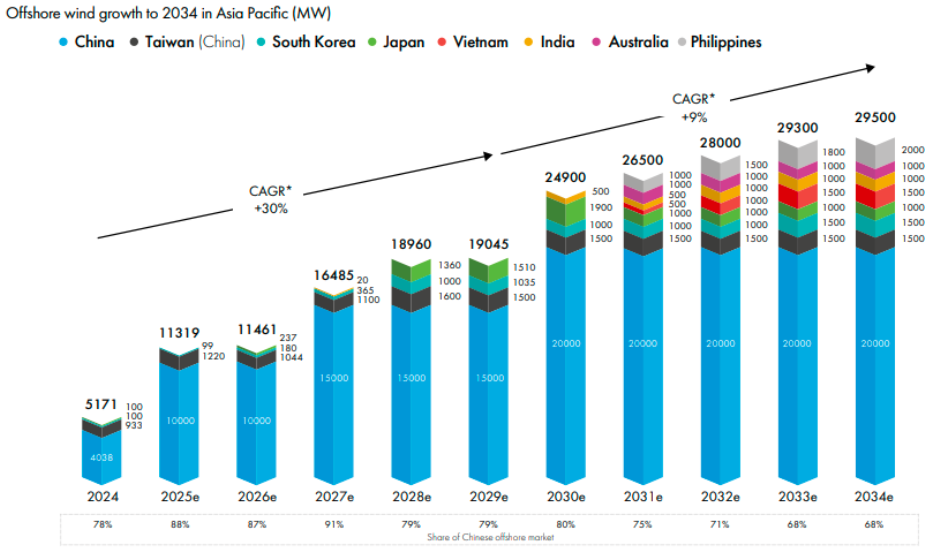

Offshore wind development in APAC surged after 2017, with China significantly contributing to this growth. By 2020, APAC surpassed Europe in new offshore wind installations and by 2022, it led in total cumulative installations. Forecasts indicate that China will hold a staggering 87–91 percent share of APAC’s offshore market until at least 2027, supported by the most advanced offshore wind supply chain in the world.

GWEC estimates that global offshore wind capacity will see an addition of 215 GW over the next ten years. Of this, 36 percent is expected to be installed between 2025 and 2029, with the remaining 64 percent from 2030 to 2034. Within APAC, the leading markets fueling this growth will include China, Taiwan, South Korea, Japan, and the Philippines.

This growth is not solely driven by energy targets; it is increasingly influenced by industrial policies that advocate for local content requirements (LCRs). Countries are striving to establish domestic supply chains to lessen dependence on foreign resources. Taiwan has made notable advances, with companies like Siemens Gamesa and Vestas producing turbine nacelles locally. South Korea and Japan also plan to develop offshore wind supply chains by 2030 to meet domestic demands and enhance export capabilities.

However, supply chain readiness is a critical challenge. Current local capabilities meet immediate demands, but risks arise due to the concentration of component manufacturing—particularly for nacelles, blades, and electrical systems. A joint report by GWEC and ERM highlighted that a lack of diversified production outside China could hinder timely deployment in emerging APAC markets. Countries like the Philippines, India, and Australia are working to build the necessary skills, infrastructure, and facilities needed to support commercial-scale offshore wind projects.

Investment is increasingly directed toward manufacturing, logistics, grid integration, and workforce training. Governments are aligning industrial policies with clean energy objectives, while the private sector seeks clearer permitting processes and project timelines to facilitate capital flow for supply chain expansion.

In summary, APAC’s offshore wind market is poised for substantial growth, but achieving the anticipated 215 GW of new capacity by 2034 requires urgent actions to strengthen supply chains, encourage regional collaboration, and ensure stable policy environments. With coordinated investments and strategic planning, APAC could become a global leader in offshore wind energy in the coming decades.

Focusing on China, the country’s offshore wind market is expected to recover from a decline in 2024 and gain momentum in 2025 as regulatory clarity improves for deep-water projects. GWEC projects that China will add 165 GW of offshore wind capacity from 2025 to 2034, solidifying its status as a global leader.

Despite recent policy changes, including new market-based pricing mechanisms introduced by the National Development and Reform Commission (NDRC) and the National Energy Administration (NEA), the outlook remains optimistic. Projects initiated before June 2025 will benefit from a price-difference settlement under existing policies, while those starting afterward will see prices determined by local renewable energy targets and competitive bidding.

While some stakeholders express concerns about uncertain returns affecting investor confidence, historical trends show resilience. Following a surge in installations in 2021 due to the expiration of Feed-in Tariffs (FiTs), China added 5 GW in 2022 and 6.3 GW in 2023 without direct financial incentives, indicating the sector’s maturity and adaptability.

Overall, the Chinese offshore wind industry is well-positioned to meet ongoing reforms and fulfill the country’s climate objectives, including its commitment to peak carbon emissions by 2030 and achieve carbon neutrality by 2060.