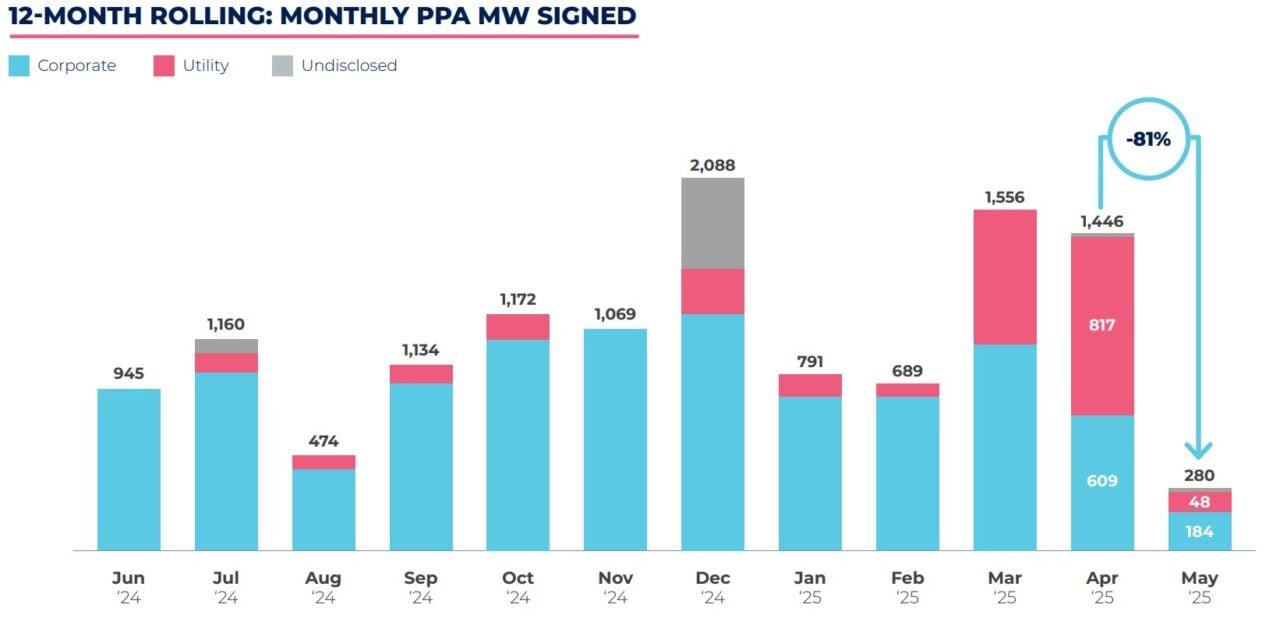

In May 2025, Europe recorded its lowest volume of power purchase agreements (PPAs) since 2020, with only 280 megawatts (MW) signed, according to Swiss consultancy Pexapark. This figure marks a nearly 80% decline from April’s total and represents a 45% drop in the number of deals, bringing the total to just 12 agreements, a level comparable to much of 2022.

The UK led the continent in PPA activity, signing four agreements totaling 113 MW. Ireland followed with two contracts for 49.3 MW, and France also recorded two agreements, amounting to 26.9 MW. Corporate PPAs dominated the market, contributing 184 MW, while utility PPAs accounted for 48 MW. Solar PV agreements represented the majority, with 174 MW across nine deals.

The largest PPA of the month was a solar agreement between Network Rail, a state-owned transport company, and EDF Renewables, which involves an annual offtake of 64 GWh over a 14-year period, equating to an estimated 65 MW. Additionally, the UK pub chain Marston signed a PPA for rooftop solar installations across 120 of its locations, financed by Atrato Onsite Energy.

French telecom company Iliad Group was particularly active, signing four of the 12 PPAs in May. Three of these deals included solar PV projects that totaled 60 MW, distributed across France, Poland, and Italy. Earlier in the year, Iliad contracted nearly 90 MW of solar PPAs with Engie and Statkraft.

Despite the overall decline in both the volume and number of PPAs, Pexapark noted a slight increase of 1.2% in its composite PPA price index for Europe, rising to an average of €49.3 per megawatt-hour (MWh). Poland experienced a 4.6% increase in PPA prices, attributed to a recovery in power futures and improved market sentiment. In contrast, France saw a 1.3% decrease in PPA prices.

The current market trends highlight both the challenges and opportunities within Europe’s renewable energy sector. The substantial decline in PPA capacity in May serves as an indicator of market fluctuations, while the slight increase in prices suggests resilience in specific markets like Poland.